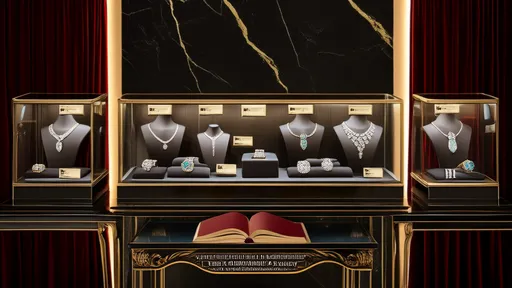

In the glittering world of high-end jewelry, a new trend is quietly revolutionizing how luxury is consumed: the jewelry library. No longer confined to traditional ownership models, affluent consumers are now embracing the concept of borrowing million-dollar pieces through sophisticated credit-based systems. This emerging "credit economy" for fine jewelry represents a fascinating intersection of trust, financial innovation, and changing consumer behavior in the luxury sector.

The concept seems almost counterintuitive at first glance - how does one lend what insurance companies often classify as "uninsurable" due to astronomical values? Yet specialized jewelry libraries have developed intricate systems combining blockchain technology, biometric verification, and old-fashioned reputation assessment to make this possible. These institutions don't merely rent jewelry; they extend lines of credit based on a client's entire financial ecosystem, from investment portfolios to social capital.

At the heart of this model lies a fundamental shift in how we perceive value in luxury goods. Where traditional appraisal focuses on gemological characteristics, jewelry libraries evaluate what they call "wearability equity" - the social and professional enhancement potential of each piece. A $2 million sapphire necklace might carry different credit terms than a $3 million diamond bracelet not because of price difference, but based on data showing which piece generates more networking opportunities for the borrower.

The clientele for these services reveals surprising patterns. While celebrities dominate the visible user base, private bankers and corporate lawyers actually form the largest borrower demographic. These professionals treat high-value jewelry as tactical assets for high-stakes negotiations and client meetings, where the right piece can subtly shift power dynamics. One Geneva-based jewelry library reported a 47% increase in corporate memberships since 2022, with pieces often booked months in advance for important merger discussions.

Risk management in this rarefied world operates on multiple levels. Beyond standard credit checks, jewelry libraries maintain what insiders call "social collateral" networks. Defaulting on a jewelry loan doesn't just affect one's financial credit; it can trigger exclusion from invitation-only events and professional circles that these institutions quietly facilitate. This creates a powerful enforcement mechanism that traditional lenders could never replicate.

The psychological dimension of borrowing versus owning luxury items has spawned an entire consultancy niche. Behavioral economists working with jewelry libraries note that the temporary nature of possession actually increases the emotional impact of wearing exceptional pieces. Unlike owned jewelry that becomes familiar, borrowed treasures maintain their mystique, creating what researchers call the "Cinderella effect" - heightened confidence and perceived social status during the wearing period.

As this market matures, unexpected secondary markets are emerging. Some jewelry libraries now offer "style futures," allowing clients to option pieces for major future events at today's credit terms. Others have developed jewelry credit derivatives that enable portfolio diversification across different gemstone categories. The most exclusive libraries even provide "narrative enhancement" services, crafting bespoke histories for borrowed pieces to impress particularly discerning audiences.

Critics argue this system exacerbates wealth inequality by creating yet another privileged access channel. However, proponents counter that it democratizes luxury experiences that were previously completely inaccessible. A mid-level executive might never afford a $5 million ruby parure, but could strategically borrow one for a career-defining presentation. The jewelry library model, they argue, represents a more efficient allocation of luxury assets in an increasingly experience-driven economy.

The environmental impact presents another complex dimension. By maximizing utilization of existing jewelry rather than driving new production, these systems theoretically reduce mining demands. Yet the carbon footprint of constantly transporting and securing high-value items between vaults and wearers remains substantial. Some libraries are experimenting with "green credit" programs, offering better terms for clients choosing pieces with verified ethical sourcing.

Looking ahead, the jewelry credit economy shows no signs of slowing. As digital verification technologies advance and new wealth generations prioritize access over ownership, these systems will likely expand beyond ultra-high-net-worth individuals. The next frontier may be fractional jewelry credit - allowing groups to collectively borrow exceptional pieces, or even blockchain-based shared ownership models where tokens represent wearing rights rather than full possession. In the alchemy of modern luxury, gold is being transformed not into lead, but into data points in an intricate dance of trust and temporary splendor.

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025

By /Jul 4, 2025